Describe Debt Using a Call Option

Investors have the choice to select an expiration date for the contract. Calls give the buyer the right but not the obligation to buy the underlying asset.

Call Debit Spread Option Strategy Explained The Options Bro

In your answers identify the positions that the debt holder takes on each asset ie.

. If the premium is 2 per share and the call option is for 100 shares at 60 the investor would pay a 200 premium for this transaction. Describe Wesleys debt using a call option. The debt holders will therefore receive the strike price and give up the firm.

The purchase of call options involves a premium amount for completing the trading transaction. From a debt holder perspective describe a companys debt using a call option. Marketable Securities Marketable securities are unrestricted short-term financial instruments that are issued either for equity securities or for debt securities of a publicly listed company.

In financial markets typical underlying assets are stocks bonds and commodities. When the debt falls due if the value of the operating assets is higher than the amount of the debt to be repaid the shareholders exercise their call option on the operating assets and pay the creditors the amount of the debt outstanding. In your answers identify the positions that the debt holder takes on each asset ie.

Ad Smart Options Strategies shows how to safely trade options on a shoestring budget. For US-style options a call is an options contract that gives the buyer the right to buy the underlying asset at a set price at any time up to the expiration date. I am unable to find the book I need.

Buyers of European-style options may exercise the option to buy the underlying assetonly on the expiration date. A call option is a contract that gives an investor the right but not obligation to buy a certain amount of shares of a security or commodity at a specified price at a later time. A call option commonly referred to as a call is a form of a derivatives contract that gives the call option buyer the right but not the obligation to buy a stock or other financial instrument at a specific price the strike price of the option within a specified time frame.

Both have the same strike price. The call premium for a bond or debt security is also called the redemption premium. A call option gives the buyer the right to purchase a security at a specific price for a specific period of time.

A call option definition is an option contract that gives the buyer the right but not the obligation to purchase an agreed quantity of an underlying asset at the predefined price strike price within a fixed period of time until its expiration date. The buyer of the call option earns a right it is not an obligation to exercise his option to buy a particular asset from the call option seller for a stipulated period of time. Options expirations vary and can be short-term or long-term.

There will be two assets and only one is an option. The value of a call option can never be negative because it is an option and the holder is not under any obligation to exercise it if it has no positive value. As of June of 2016Facebook FBhad no debtSuppose the firms managers consider issuing zero-coupon debt with a face value of 231 billion due in January of 2019 19 monthsand using the proceeds to pay a special dividendFB has 231 billion shares outstandingwith a market price June2016of 11662The risk-free rate over this horizon is 025.

Once the buyer exercises his option before the expiration date the seller has no other choice than to sell the asset at the strike. The buyer pays a premium to the seller in exchange for this right. You can request for your textbook to be answered.

If the value of the firm exceeds the required debt payment the call will be exercised. Download Smart Options Strategies free today to see how to safely trade options. A call option is a financial instrument that provides the buyer the right but not the obligation to buy an underlying asset at a set price within a certain timeframe.

The buyer of the call option has the right but not the obligation to buy an agreed quantity of a particular commodity or financial instrument from the seller of the option at a certain. Call option is a derivative contract between two parties. A call option is an agreement that gives you the right to buy stocks bonds commodities or other securities at a specific price up to a defined expiration date.

Value of Call Option max0 underlying assets price exercise price Example. Calls give the holder the right but not the obligation to buy bonds at a pre-set. A calendar or horizontal call spread is created when you buy long term call options and sell near term call options.

If the value of the firm does not exceed the required debt payment the call will be worthless the firm will declare bankruptcy and the debt holders will be entitled to the firms assets. Ben Jordan is a trader in an. A call option is a contract between a buyer and a seller that gives the option buyer the right but not the obligation to buy an underlying asset at the strike price on or before the expiration date.

The following formula is used to calculate value of a call option. A call option often simply labeled a call is a financial contract between two parties the buyer and the seller of this type of option. Debt options are derivatives contracts that use bonds or other fixed-income securities as their underlying asset.

While you may get the book resolved within 15-20 days subject to expert availability and can access. From a debt holder perspective describe a companys debt using a put option. Options are an advanced strategy that can help investors limit risk increase income and plan ahead.

To profit from changes in implied volatility and from time decay use a calendar call spread. In this situation the seller also known as a call. Based on factors such as the near-term outlook.

This is the opposite of a put option. From a debt holder perspective describe a companys debt using a call option. Call options price.

They differ only in regards to the expiration date. A call option is a financial contract that gives the holder or buyer the right to purchase a stock bond commodity or other security within a specified time period at a predetermined price. From a debt holder perspective describe a companys debt using a call option.

So you will find all the answers to questions in the textbook indexed for your ease of use. In options terminology T he call premium is the amount that the purchaser of a call option must pay to the writer. A call option is a contract that gives the buyer of the option the right to purchase a security such as a specific stock at a specific price referred to.

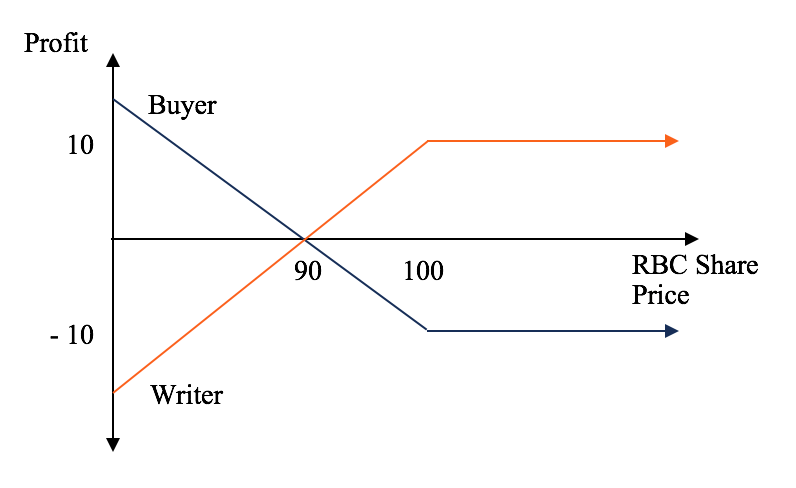

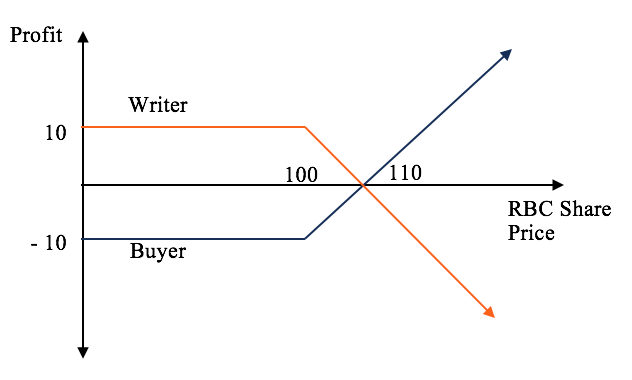

Options Calls And Puts Overview Examples Trading Long Short

Options Calls And Puts Overview Examples Trading Long Short

Options Payoffs And Profits Calculations For Cfa And Frm Exams Analystprep

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Apr_2020-01-444533c81f1a408d93bb4599cc86f3b6.jpg)

No comments for "Describe Debt Using a Call Option"

Post a Comment